See EY Global Tax Alert Malaysia releases 2019 Budget dated 4 December 2018 and EY Global Tax Alert Malaysia enacts 2019 Budget proposals dated 3 January 2019. 7 February 2011 CONTENTS Page 1.

Malaysia Kul Travel Requirements

Maximum permissible holdings 93.

. Has ordered ABC Sdn Bhd to. The provisions relating to the tax treatment of interest expense are. Its official the coronavirus or COVID-19 is now a global pandemic.

The Centers for Disease Control and Prevention CDC has determined Malaysia has a high level of COVID-19. S33 1 general deductibility of expenses. Owns 25 shares of ABC Sdn Bhd owns 25 shares of ABC Sdn Bhd ii.

The situation in Malaysia took a bleaker turn in the past week with the number of cases spiking and the restriction movement order kicking in. Terms Condition TC FAQS Contact Us FAQS Contact Us. This Corporate Interest Restriction only applies to individual companies or groups of companies that will deduct over 2 million in a 12-month period.

There is also no restriction for non-residents to transfer abroad in foreign currency all profits returns and divestment proceeds from their investments in Malaysia. Read the Department of States COVID-19 page before planning any international travel and read the Embassy COVID-19. Interest restriction under subsection 332 of the ITA 3 - 7 7.

For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of. The transfer of land can be done only for the title that has no restriction in interest or caveat. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

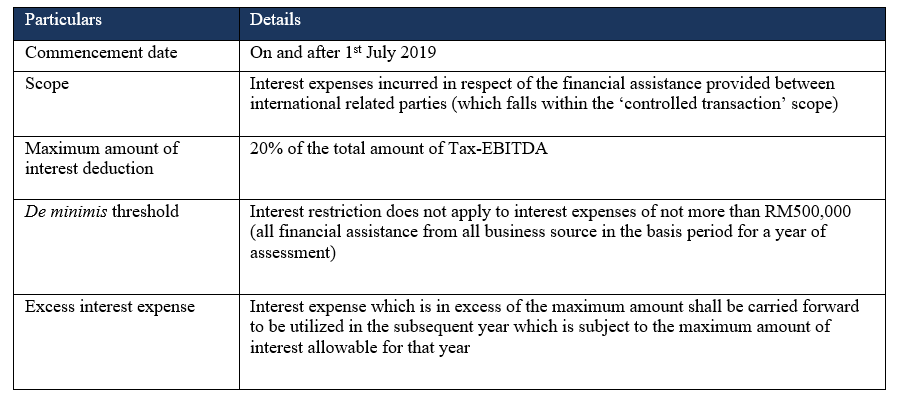

Disposal of interest in shares requiring approval 90. Tax treatment of interest expense 1 - 3 6. This provision known as earnings stripping rules ESRs in tax parlance was introduced with effect from 1 January 2019 in the form of section 140C.

BNM is committed in ensuring FEP continues to support the competitiveness of the Malaysian economy by facilitating a more conducive environment for. On 28 June 2019 the Income Tax Restriction on Deductibility of Interest Rules 2019 were gazetted to implement the Earnings Stripping Rules ESR under Section 140C of the Income Tax Act 1967 ITA which has first been announced during the presentation of the 2019 Budget to the parliament. However for title with restriction in interest or caveat prior consent from the interested parties must be obtained first.

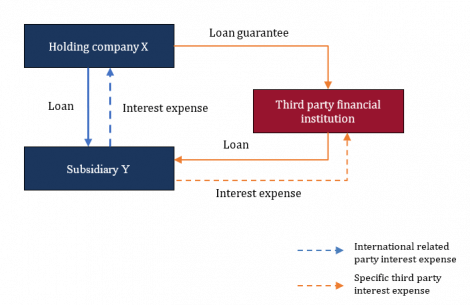

Any payment of interest by ABC Sdn Bhd to ABC Co. Holds a 35 stake in ABC Sdn Bhd and also owns 65 equity capital in XYZ Co. If you decide to travel to Malaysia.

In Malaysia moneylending an activity of lending money with interest with or without security by a licensed moneylender to a borrower as defined by the Moneylenders Act 1951 are often confused with loan sharking. Power of Bank to specify standards on shareholder suitability 92. 22011 Date of Issue.

Copyrights 2022 All Rights Reserved by Attorney Generals Chambers of Malaysia. Gains or profits in lieu of interest 1 3. S33 1 a specific deductibility of interest expense.

Subsequently on 5 July 2019 the Inland Revenue Board of Malaysia IRBM published the guidelines for restriction on deductibility of interest against business income ie. Therefore tax will be charged at the rate of 3 on net profits from its Labuan business activity for the basis period for. New earnings stripping rules.

Related provisions 1 4. And you must keep the receipt of the donation. Section 140C Restriction on deductibility of interest.

Section 140C of the Income Tax Act 1967 ITA. Application procedures for section 87 88 or 89 91. Will be subjected to interest restriction under Section 140C of the Act.

Bank Negara Malaysia BNM continues to maintain a liberal foreign exchange policy FEP which is part of its broad prudential toolkits to maintain monetary and financial stability. Malaysias Department of Insolvency MDI is the lead agency implementing the Insolvency Act of 1967 previously known as the Bankruptcy Act of 1967. TO WHOM THE LAND CAN BE TRANSFERRED.

Income Tax Restriction on Deductibility of Interest Rules 2019 PUA. Abolition of the flat tax rate. Although Section 140C of the ITA took effect from 1 January 2019 its implementation however requires certain rules to be prescribed by the Minister of Finance and in this regard the Income Tax Restriction on Deductibility of Interest Rules 2019 PU.

Notification on acquisition or disposal of interest in shares of licensed person Division 2 Action by Bank in event of breach 94. Contrary to money lending loan sharking as defined by a simple Wikipedia search is an illegal activity of offering loans at. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government.

27 July 2019. With the deletion of Section 7 of the LBATA effective from 1 January 2019 a Labuan taxpayer can no longer elect to pay tax at the fixed amount of MYR 20000 for each year of assessment. The earnings stripping.

Visit the CDC page for the latest Travel Health Information related to your travel. Recently the Inland Revenue Board of Malaysia IRBM issued the Restriction on Deductibility of Interest Rules ESR which are intended to prevent base erosion through the use of excessive interest expense or any payments which are economically equivalent to interest via controlled financial assistance. The discussion below draws from various sources section 140C Rules vide PU order 1752019 IRB guidelines dated 5 July 2019 and FAQ.

On October 6 2017 the Bankruptcy Bill 2016 came into force changing the name of the previous Act and amending certain terms and conditions. Foreign Investment Committee FIC guidelines prior to June 30 2009 states that any acquisition of property by foreign interest requires FIC approvals. Transfer of land is a process to change the name of registered proprietor in the title.

INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No. Live animals-primates including ape monkey lemur galago potto and others. Egg in the shells.

Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. In Malaysia in computing the adjusted income for a person in a basis period of a year of assessment YA interest expenses are generally deductible against the gross income of a person provided certain conditions are metThe Income Tax Restriction on Deductibility of Interest Rules 2019 Rules has recently been gazetted and came into. S33 4 and 5 interest deductible when due to be paid and relevant compliance requirement.

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

In The Matter Of Interest Crowe Malaysia Plt

Malaysia 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Malaysia In Imf Staff Country Reports Volume 2022 Issue 126 2022

News Education Malaysia Global Services

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

In The Matter Of Interest Crowe Malaysia Plt

Malaysia Kul Travel Requirements

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Special Report On The 12th Malaysia Plan 2021 2025 Industries Insist A Lot More Time Needed To Adjust To 15 Foreign Labour Cap The Edge Markets

Malaysia 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Malaysia In Imf Staff Country Reports Volume 2022 Issue 126 2022

Malaysia Finally Reopens With Simpler Sops Certain Mask Off Activities Open Borders Codeblue

Malaysia Authorities To Ease Domestic Covid 19 Restrictions From May 1 Update 67 Crisis24